Max 529 Contribution 2024

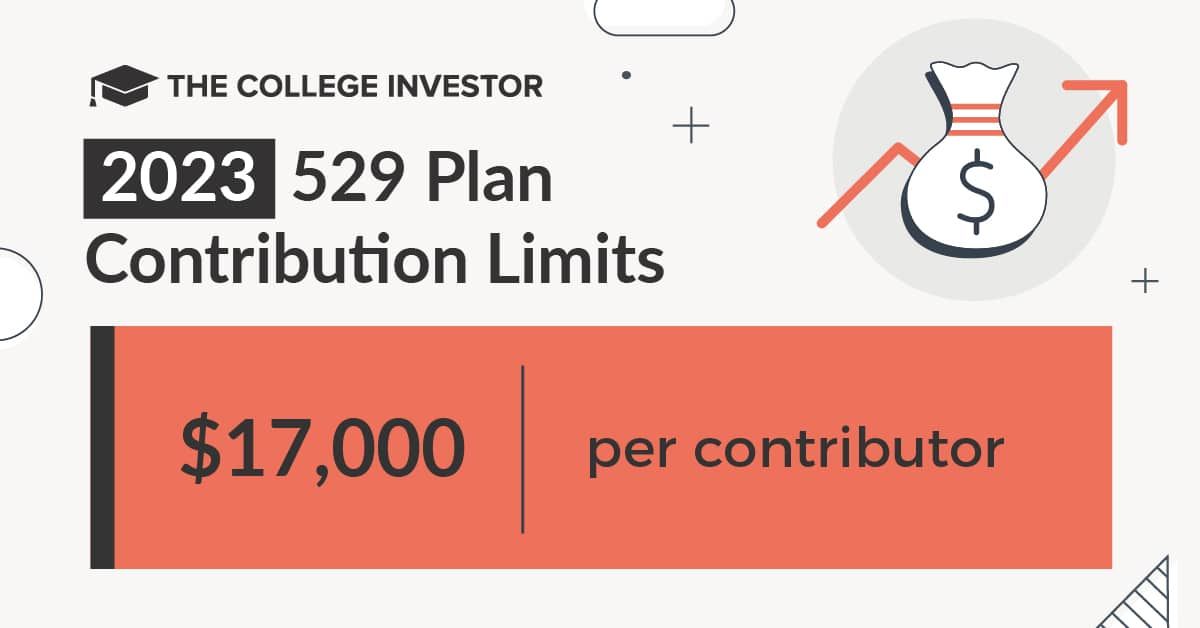

Max 529 Contribution 2024. In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor. The 529 account must have been open for more than 15 years.

529 plans have high contribution limits, which are generally. Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution limit!

Max 529 Contribution 2024 Images References :

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

Irs 529 Contribution Limits 2024 Rory Walliw, Get answers to the most common questions about the future scholar college savings plan:

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2024 Elset Horatia, Instead, limits are based on aggregate contributions and controlled by states.

Source: www.elementforex.com

Source: www.elementforex.com

529 Plan Contribution Limits For 2023 And 2024 Forex Systems, Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution limit!

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans.

Source: www.mybikescan.com

Source: www.mybikescan.com

2024 529 Contribution Limits What You Should Know MyBikeScan, Review how much you can save for college in these plans.

Source: ehsaasprogramonline.com.pk

Source: ehsaasprogramonline.com.pk

2024 529 Contribution Limits Your Ultimate Guide to Max Contributions, It’s essential to understand the specific limits in your state to plan your contributions effectively.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Maximum Contributions YouTube, Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans.

Source: julianawnoni.pages.dev

Source: julianawnoni.pages.dev

Iowa 529 Contribution Limits 2024 Nevsa Adrianne, 529 contribution limits are set by states and range from $235,000 to $575,000.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Here is a rundown of how those benefits work.

Source: aidanywinonah.pages.dev

Source: aidanywinonah.pages.dev

2024 Tsp Contribution Limits 2024 Lok Inge Regine, Each state sets a maximum 529 plan contribution limit per beneficiary.

Posted in 2024