When Are Corp Taxes Due 2025

When Are Corp Taxes Due 2025. This article will cover key dates small business owners need to know to file their 2023 taxes, make quarterly payments. Key tax deadlines are coming up in 2024 for llc and corporation businesses.

There are a few critical things to remember. Congress also could change other business.

Many Tax Deadlines Are Fast Approaching.

File business taxes after an extension, c corporations and sole proprietors using a calendar year:

Key Tax Deadlines Are Coming Up In 2024 For Llc And Corporation Businesses.

Here are the dates and irs forms you need to know.

When Are Corp Taxes Due 2025 Images References :

Source: accotax.co.uk

Source: accotax.co.uk

When is Corporation Tax due? Guide to rates and when to pay Accotax, The tax filing deadline for most businesses in the u.s. This is the due date for calendar year business filers.

Source: taxfoundation.org

Source: taxfoundation.org

Corporate Tax Rates Around the World Tax Foundation, A corporation must pay its tax due in full no later than the due date for filing its tax return (not including extensions). If your company operates on a calendar.

Source: www.statista.com

Source: www.statista.com

Chart Global Corporation Tax Levels In Perspective Statista, However, the form 1120 due date for corporations. For partnerships, llcs taxed as a partnership, and s corps, taxes are due.

Source: bu.com.co

Source: bu.com.co

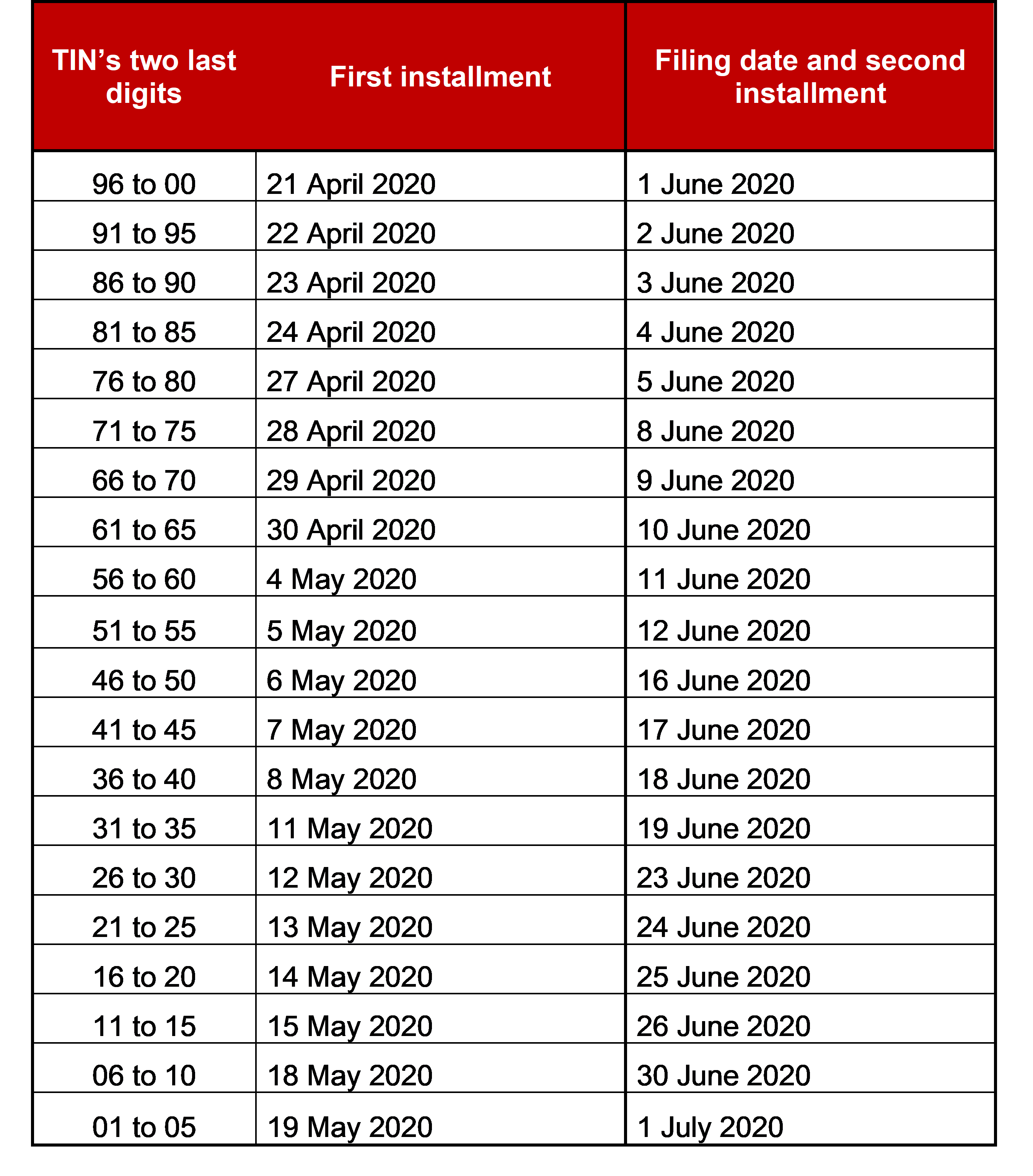

Corporate Tax filing and paying due dates postponed Brigard, A corporation must pay its tax due in full no later than the due date for filing its tax return (not including extensions). If you choose the option to pay 100% of your previous year’s tax liability, any unpaid taxes will be due when you file your 2024 individual tax return by the april 2025.

Source: exceltemplate77.blogspot.com

Source: exceltemplate77.blogspot.com

Corporation Tax Calculator Excel Excel Templates, Key tax deadlines are coming up in 2024 for llc and corporation businesses. So if you become an s corp for the year 2024, let’s say.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Corporate tax definition and meaning Market Business News, Congress also could change other business. Then you’re gonna be filing your first 1120 s, which is the corporate tax filing for it s corp.

Source: businessadvice.co.uk

Source: businessadvice.co.uk

When Is Corporation Tax Due?, There are a few critical things to remember. Key tax deadlines are coming up in 2024 for llc and corporation businesses.

Source: taxfoundation.org

Source: taxfoundation.org

Corporate Tax Definition TaxEDU Tax Foundation, If you choose the option to pay 100% of your previous year’s tax liability, any unpaid taxes will be due when you file your 2024 individual tax return by the april 2025. Here are the dates and irs forms you need to know.

Source: irelandsfuture.com

Source: irelandsfuture.com

Infographics Ireland's Future, However, the form 1120 due date for corporations. Key tax deadlines are coming up in 2024 for llc and corporation businesses.

Source: www.motherjones.com

Source: www.motherjones.com

The History of US Corporate Taxes In Four Colorful Charts Mother Jones, For example, if a corporation operates on a calendar year, the due date for its form 1120 would be april 15, 2024, for the 2023 tax year. Note that if you are using a fiscal year that.

File Business Taxes After An Extension, C Corporations And Sole Proprietors Using A Calendar Year:

Congress also could change other business.

This Article Will Cover Key Dates Small Business Owners Need To Know To File Their 2023 Taxes, Make Quarterly Payments.

View due dates and actions for each month.

Posted in 2025